Alphabet Inc. - Waiting on AI Breakthrough - FY24

As companies start to reveal their earnings for the fiscal year 2024, here are the results for a stock on my watchlist along with a business valuation.

Welcome to my summary of Alphabet’s ($GOOG/$GOOGL) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Year-End Results

Alphabet Inc. (GOOGL), the parent company of Google, deserves commendation for its dominance in search and its impressive growth in the cloud sector. The impact of artificial intelligence (AI) is still unfolding and yet to be fully assessed. However, given the rollout of their autonomous vehicle venture, Waymo, it is evident that AI advancements hold promising potential for the future.

Revenues increased by 14%.

Earnings per share (EPS) experienced a 39% increase.

This was the first year that GOOGL issued a dividend at $0.60 per share, at a payout ratio of 7.5%.

Operating cash flow (OCF) was $125 billion, and free cash flow1 (FCF) was approximately $72 billion.

The net profit margin improved to around 28.6%.

The long-term debt-to-equity ratio is at an all-time low of 0.07 with a FCF to Debt of 3.22. GOOGL is strapped with cash flows.

The annualized average growth rate of the share price was +23% over five years, +10% over three years, and +38% over the past year.

The number of outstanding shares marginally decreased, continuing its downward trajectory. Good news for shareholders.

Investor Call Highlights

A Target for Many. The company faced increased scrutiny from regulators concerned about potential antitrust violations and monopolistic practices. Critics argued that Alphabet's dominance in various sectors, including search and advertising, stifles competition and innovation.

$75B in Capex for 2025. Analysts are concerned that $75 billion is excessive, especially following news that DeepSeek did not require as much investment for a seemingly superior product. Most of this expenditure is directed toward data centers and servers. However, the advantage of having a diverse business is that GOOGL can repurpose capacity, whether through Google services or Google Cloud.

DeepSeek Take. The cost of utilizing AI is expected to continue decreasing, making more use cases feasible. This is the opportunity space that Google (GOOGL) aims to capitalize on.

Here is a great reaction to Google’s earnings:

My Own Valuation

We all recognize that Google (GOOGL) is a strong technology company—there's no doubt about it. However, when substantial amounts of money are invested into AI without a clear end result, market skepticism is understandable.

It's important to remember that when Google Cloud was first launched, it started with operating losses. Today, it stands as one of the world's best cloud services, generating billions in operating income.

Return on investment (ROI) will be crucial for validating GOOGL's valuation. If you believe AI applications will yield tangible, substantial ROI, then there's no doubt that GOOGL is a solid investment for the future. However, if you have doubts, waiting for a better entry point is reasonable. The risk, however, is that you might miss out on growth opportunities if AI advancements occur sooner rather than later.

My question is, if AI is to move beyond language learning models (LLMs), which are becoming increasingly common and commoditized, extracting more value from AI itself is essential for success. Who will emerge victorious in this race?

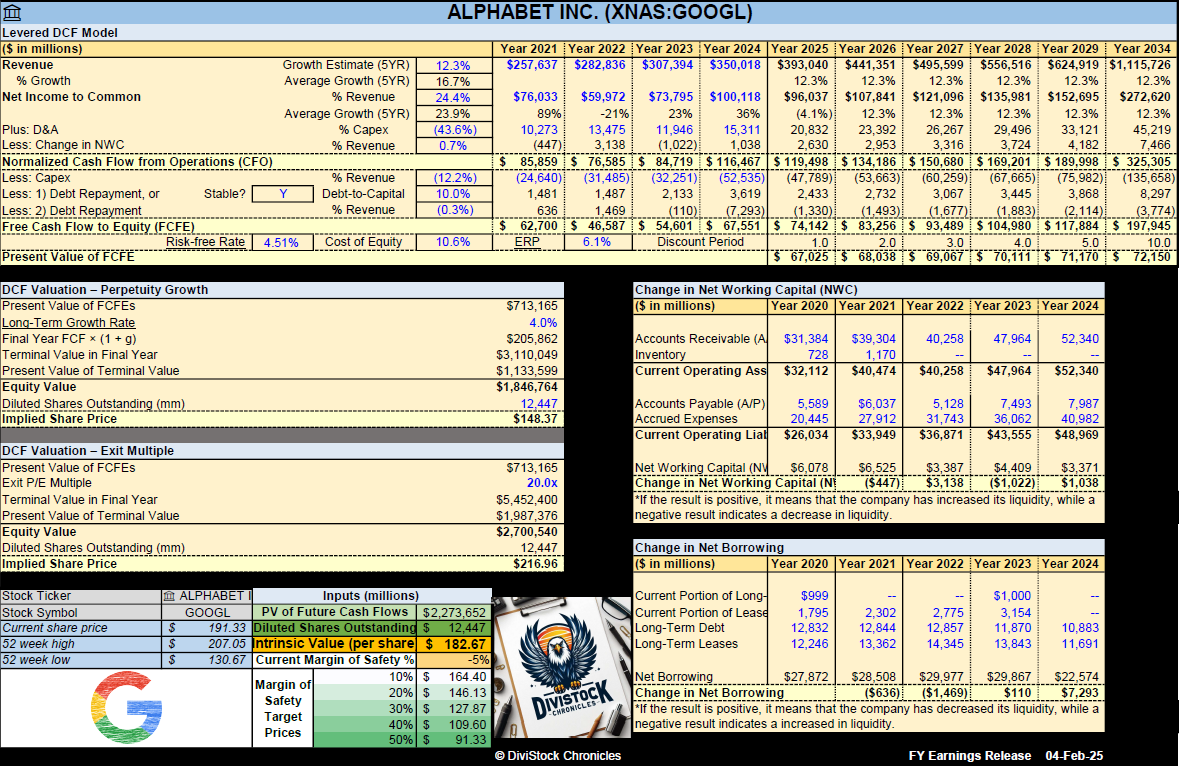

Net Income Growth: The spreadsheet presents a growth estimate that reflects the company's anticipated rise in net income for the upcoming five years, based on the average of projections from multiple analysts. The estimate is additionally adjusted down to reflect a more conservative approach.

Free Cash Flow to Equity (FCFE): This is calculated for several years, showing the amount of cash that could be distributed to shareholders after all expenses, reinvestment, and debt repayments.

Discounted Cash Flow (DCF) Valuation: The spreadsheet includes a DCF valuation section, which is a method used to estimate the value of an investment based on its expected future cash flows. It provides two valuation methods:

Perpetuity Growth: Calculated using a long-term growth rate and discounting future cash flows.

Exit Multiple: Based on an exit price-to-earnings (P/E) multiple.

Current Share Price vs. DCF Value: A table compares the current share price of ATD with the estimated share price based on DCF valuation, suggesting whether the stock is undervalued or overvalued according to the model.

Disclaimer: The information provided in this valuation analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy, sell, or hold any specific stocks or securities. The valuation model presented here relies on certain assumptions, including projected future cash flows and discount rates.

Other FY24 Reviews

Pepsi - Fizzes Out - FY24

Welcome to my summary of Pepsi’s ($PEP) earnings report for fiscal 2024. For additional context, please refer to my earlier post detailing my valuation methodology.

Consider joining DiviStock Chronicles’ Referral Program for more neat rewards!Please refer to the details of the referral program.